BENGALURU: The e-commerce landscape in India is witnessing a convergence where quick commerce delivery services meet online retailers in their distinct ways. Major players such as Flipkart and Amazon ventured into 10-minute deliveries via small-format dark stores. At the same time, rapid-delivery specialists Swiggy, Blinkit, and Zepto are enlarging their warehouses to stock larger products, including household appliances.

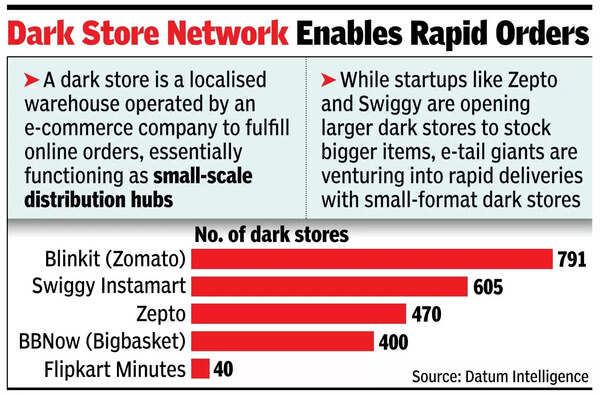

“Groceries, pick-up and drop services, even toys, stationery, and pet supplies, you name it, Swiggy delivers it. We’re weaving ourselves into the fabric of Indian life, becoming as indispensable as chai and cricket,” Swiggy cofounder and CEO Sriharsha Majety told analysts earlier this month. Kirana stores, despite their basic amenities and restricted product range, were ubiquitously present across India, serving as the sole solution for immediate purchases, whether it was snacks or fresh herbs. Covid-19 transformed delivery services fundamentally. The emergence of rapid commerce led to the establishment of localised warehouses, which evolved into dark stores functioning as small-scale distribution hubs.

With the race heating up, Majety said he anticipates acceleration in the company’s quick commerce business growth versus originally planned. The $14 billion company is now aiming to increase its dark store area size to 4 million sft in total by March next year, which is almost doubling from the capacity of 1.5 million sft in March.

Amazon is planning a pilot too in Bengaluru later this month. Meanwhile, swift-delivery providers such as Instamart (owned by Swiggy), Blinkit (owned by Zomato), and Zepto are expanding their storage facilities to accommodate bigger home appliances and various items not traditionally found in dark stores.

At Zepto, the firm is opening dark stores of up to 8,000 sft to house larger products such as water heaters, air purifiers, and jewellery. “It’s growing steadily and does well enough to be categorised as a quick commerce category. With the rise in Air Quality Index (AQI) in northern regions, air purifiers were in high demand and similarly with the dip in temperatures, we expect heaters and blowers to do well,” a company spokesperson told TOI.

Zepto’s primary revenue driver remains grocery sales. However, the spokesperson noted that additional categories, including beauty products, personal care items, household maintenance goods, and electronic appliances, have shown steady growth and are gaining momentum. BigBasket’s Founder and CEO Hari Menon emphasised that whilst customers seek extensive product variety and competitive pricing, he remains prudent about BBNow’s quick commerce network expansion. “You cannot have too many larger warehouses. So, 10 mins will happen through smaller warehouses (3,000 to 4,000 sft) and 30 to 45 mins will be facilitated through larger warehouses that will stock large appliances and luxury and expensive merchandise. This way margins are protected,” Menon said.

Swiggy, for instance, has been expanding its storage capacity to meet demands for wider product variety. The company upgraded from dark stores measuring 2,500-2,800 sq ft to facilities of 3,500-4,500 sq ft, enabling storage of up to 20,000 items. In major cities, Swiggy introduced megapods spanning 8,000-10,000 sq ft, capable of storing 50,000 items and delivering to customers within 30 minutes. Swapnil Potdukhe of JM Financial Institutional Securities told TOI they do not anticipate seeing quick commerce player focus on profitability any time soon.