THE Ministry of Trade and Industry (MTI) is launching a total of 14.07 hectares (ha) of industrial land across 10 sites through the Industrial Government Land Sales (IGLS) programme for the first half of 2025.

On Monday (Dec 30), MTI said that the government will continue to release sufficient land through the programme to ensure an adequate supply of industrial space in Singapore.

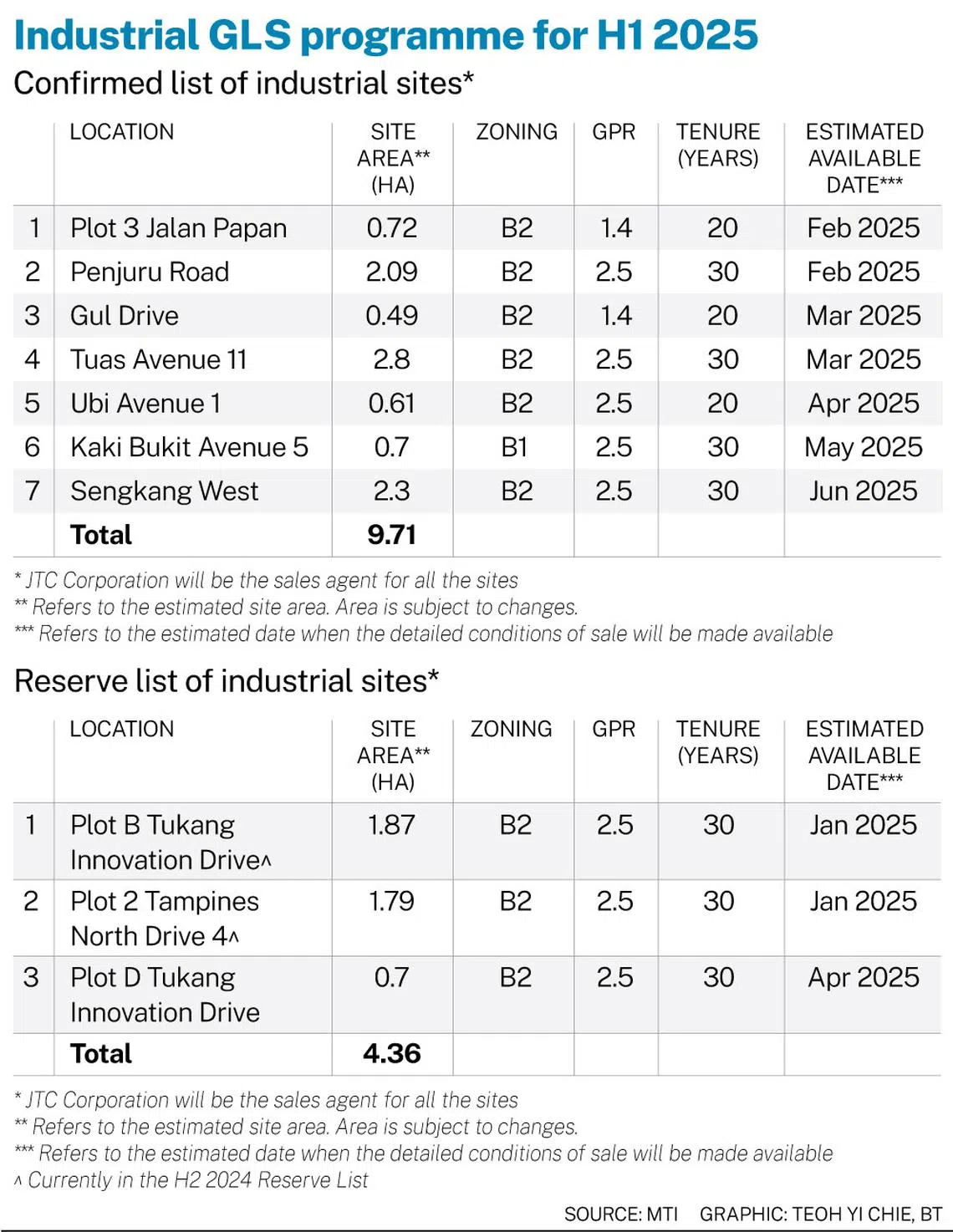

There will be seven sites on the confirmed list with a total of 9.71 ha of land, and three sites amounting to 4.36 ha on the reserve list.

Nicholas Mak, Mogul.sg’s chief research officer, said the seven confirmed sites have a combined land area of 1.05 million square feet (sq ft). This is 68.3 per cent higher than the total land area of the five confirmed sites on the H2 2024 IGLS programme.

The supply of industrial land for sale has been raised in the H1 2025 programme, from the usual release of three to five sites on the confirmed list in the past, he added.

The move to increase land supply could have been to “maintain a steady supply of industrial space beyond 2027”, he noted.

A NEWSLETTER FOR YOU

Tuesday, 12 pm

Property Insights

Get an exclusive analysis of real estate and property news in Singapore and beyond.

This comes as the projected supply of single-used factory space is expected to decline to 2.2 million square feet (sq ft) after 2027, from 5.16 million sq ft in 2025.

Meanwhile, prices and rental rates for industrial properties rose marginally in the third quarter of 2024 from the quarter before, JTC data released in October indicated.

The price index of industrial properties for Q3 was up 0.5 per cent from the prior quarter, and represented a 2 per cent increase from the same period a year ago.

Mak expects the seven confirmed sites to yield about 2.47 million sq ft of industrial space – 74.9 per cent more than the industrial space that can be developed from the five confirmed sites in the current programme.

The growth of industrial property price and rents is also likely to moderate with a bumped-up supply, he said.

“If industrial property prices and rents were to rise at a heightened rate, it would reduce the competitiveness of Singapore as a business location… for manufacturing, logistics and technology firms,” said Mak.

But Lee Sze Teck, senior director of data analytics at Huttons Asia, highlighted that Singapore’s manufacturing sector may face headwinds in 2025 amid trade tariffs, potentially affecting demand for industrial land.

JTC Corporation will be the sales agent for all sites.

Conditions of sale and tender submissions are estimated to be available as early as February 2025 for two of the sites on the confirmed list.

One of them is Plot 3 Jalan Papan, a 0.72 ha site with a gross plot ratio (GPR) of 1.4 and a 20-year tenure; the other is a plot on Penjuru Road, 2.09 ha in size with a GPR of 2.5 and a tenure of 30 years. Both plots are in Jurong.

The Kaki Bukit Avenue 5 site on the confirmed list may attract more interest as it is zoned for B1 industrial use, said market watchers.

Huttons Asia’s Lee noted that B1 sites are in demand, adding that the last of such parcels, located at Braddell Road, was from the 2018 reserve list.

Mogul’s Mak also noted that this is the first time in a decade that the government is offering a B1 industrial land parcel for sale under the confirmed list of the IGLS programme.

“The inclusion of a B1 industrial site in the upcoming IGLS programme could be a response to the needs of light industrial users, such as businesses in the technology and information communication industries,” he said.

Two sites on the latest reserve list are currently also on the H2 2024 reserve list of the IGLS programme. One is a 1.87 ha site at Plot B Tukang Innovation Drive, and the other spans 1.79 ha at Plot 2 Tampines North Drive 4. Both have a GPR of 2.5 and a tenure of 30 years.

Sites on the reserve list are put up for tender if an interested party applies with an offer of a minimum purchase price that is acceptable to the government.

These sites are also put up for tender when there is sufficient market interest, such as when more than one unrelated party submits minimum purchase prices that are close to the government’s reserve price for the site within a reasonable period.