BIDDING at two state land tenders that closed on Thursday (Aug 1) was fairly subdued, reflecting developers’ sentiment amid a sluggish home sales market and still-high financing costs.

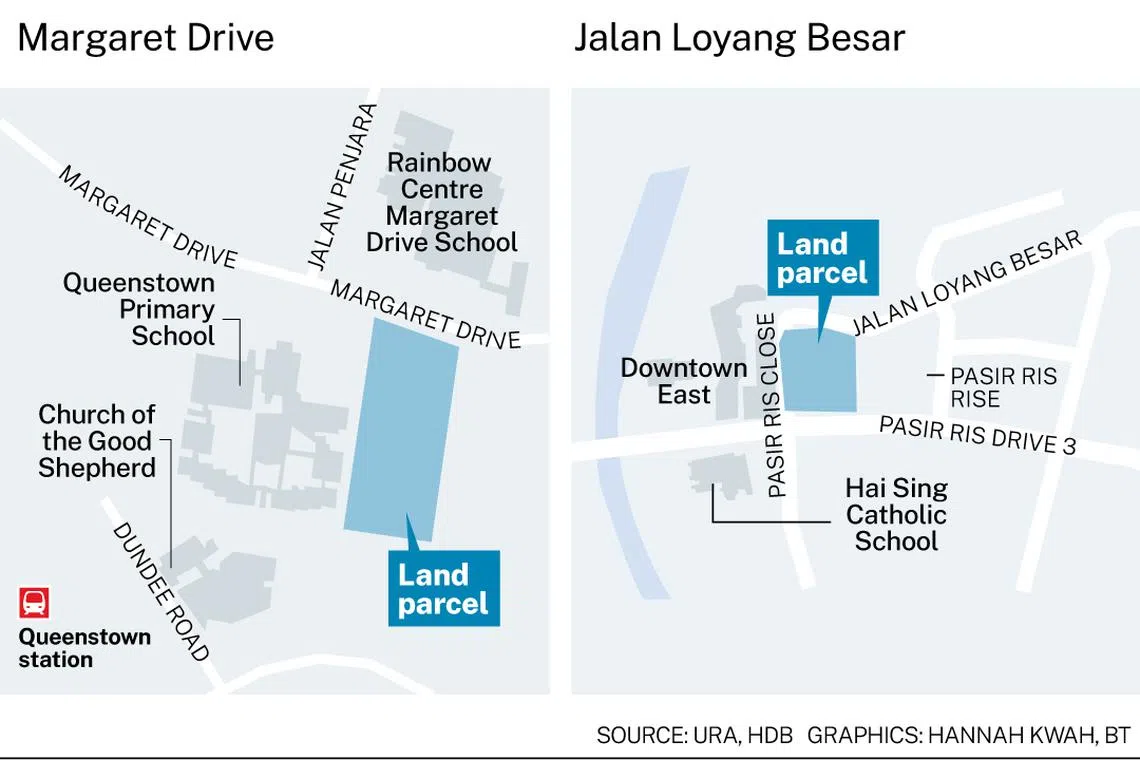

A private residential site for 460 homes in Margaret Drive in the Queenstown area drew just two bids, despite its location in an area popular with homebuyers.

Over in Pasir Ris, an executive condominium (EC) plot in Jalan Loyang Besar fetched a record-high land price for ECs, but attracted only four bids. Previous EC land tenders pulled in many more developers.

The Margaret Drive plot drew a top bid from Hong Leong group units and GuocoLand at S$497 million, or S$1,154 per square foot per plot ratio (psf ppr). It was around 5 per cent higher than Sing Holdings Limited’s bid of S$473.6 million, or S$1,100 psf ppr.

The two bids for the Margaret Drive site were at the lower end of expectations indicated by analysts previously. Up to three bids were expected, ranging from S$1,150 to S$1,250 psf ppr, given the plot’s attractive location on the city fringe and its palatable size.

In comparison, the tender for the last Government Land Sale residential site in the area – where 99-year leasehold condo Stirling Residences now stands – drew 13 bidders in 2017. The winning bid was more than S$1 billion or S$1,051 psf ppr.

A NEWSLETTER FOR YOU

Tuesday, 12 pm

Property Insights

Get an exclusive analysis of real estate and property news in Singapore and beyond.

Market watchers had anticipated more firm interest in the Queenstown area site. Chia Siew Chuin, JLL head of residential research, research and consultancy, said the absence of new private housing projects in the neighbourhood gives developers an opportunity to tap into demand from a potential pool of resale flat upgraders there.

Despite the site’s “many favourable attributes”, Orange Tee & Tie chief executive Justin Quek pointed out that developers are still contending with demand, affordability and higher costs.

The site includes a childcare centre, making it more complex to develop, said Quek. “Developers are continuing to monitor overall market sentiment, and remain generally cautious amid the gross floor area harmonisation ruling, still-high interest rates, macroeconomic uncertainty, and elevated construction costs.”

Based on the top bid for the site, analysts anticipate that the Margaret Drive project could eventually be launched at around S$2,500 psf, similar to other projects in its vicinity.

These include The Hill @ One-North, a nearby 99-year leasehold condominium launched in April, noted Nicholas Mak, Mogul.sg chief research officer.

Some smaller units at the 99-year leasehold Stirling Residences have also transacted at between S$2,500 and S$2,700 psf, said Knight Frank research head Leonard Tay.

Last month, a five-room public-housing resale flat in Margaret Drive, near Dawson estate, was sold for S$1.73 million, making it the most expensive HDB resale flat in Singapore.

In the Pasir Ris EC site, the highest among the four bids was S$557 million or S$729 psf ppr. It came from CNQC International (the parent company of Qingjian Realty), China Communications Construction Company, and ZACD.

The bid for this site in Jalan Loyang Besar that was just a shade lower – S$538.9 million or S$705 psf ppr –was by Allgreen Properties and China Construction (South Pacific) Development Co.

This was followed by the offer from Sim Lian Land and Sim Lian Development, at S$460.9 million or S$603 psf ppr. This bid was around 17 per cent lower than the S$557 million top bid.

These bids were generally within forecasts of between S$650 and S$760 psf ppr for the 28,405.5 sq m site, though more bids were expected, given the saleability of ECs in general.

There is strong pent-up demand in Pasir Ris, as it has been more than a decade since a site there was sold for EC development, said Lee Sze Teck, senior director of data analytics at Huttons Asia.

The last EC site in the neighbourhood was the adjacent Sea Horizon, which was sold in November 2012 for S$331 psf ppr.

Although the number of contenders for the Jalan Loyang Besar site was lower than expected – it was the lowest recorded in the eastern region since 2011 – JLL’s Chia noted that the tender participation was “respectable” in the current climate.

The top bid of S$729 psf ppr is also a new record land rate for EC plots, surpassing the last high of S$721 psf ppr recorded for Tampines Street 62 Parcel B, said Tricia Song, CBRE’s head of research for South-east Asia.

“The firm pricing continues to reflect developers’ confidence in the EC market, as the segment is generally not as affected by the recent property cooling measures because of the higher proportion of owner-occupiers and first-time buyers,” she said.

“There is also a limited supply of new EC units in the market, and developers are seeking a less-risky development site to add to their inventory.”

The thin margin between the top bid and the second-highest offer underscores the underlying demand for EC sites, given the current cautious bidding sentiment among developers, added Mohan Sandrasegeran, SRI head of research and data analytics.

At a land rate of S$729 psf ppr, analysts expect the Jalan Loyang Besar project to launch at prices ranging from S$1,450 to S$1,700 psf. The site can yield around 710 units,

“This might appeal to first-time buyers and HDB upgraders in eastern Singapore, as household net worth and incomes remain intact,” said Tay of Knight Frank. “After all, some recent resale transactions of ECs at Sengkang have gone beyond S$1,600 psf.”

Caveats data indicate that the median unit price of new EC units sold in the year to date is around S$1,505 psf, noted PropNex’s Wong.