CENTRAL Provident Fund (CPF) contributions to platform workers could lead to a cost increase of around US$368 million (S$494.3 million) over the next five years, according to a report released on Thursday (Nov 28) by consultancy Momentum Works. This reportedly excludes other costs, such as workplace injury compensation (WIC) insurance, which is estimated to reach US$32 million a year.

As for insurance premiums, the report notes that it is a “business discussion” between the insurer and the respective platform operators.

It will be up to the discretion of the insurers and can be calculated as a percentage of the platform workers’ net income, or by numbers of trips.

The CPF contribution from platforms begins at 3.5 per cent in 2025, increasing by an additional 3.5 per cent a year, to hit the prevailing rate of 17 per cent by 2029, for workers born in or after 1995, or those that opt in to the scheme.

The report said that workers’ CPF contribution starts at 12.1 per cent in 2025 — an approximation of the age group split across platform workers — and will increase till it hits the prevailing rate of 20 per cent as well. (*see amendment note)

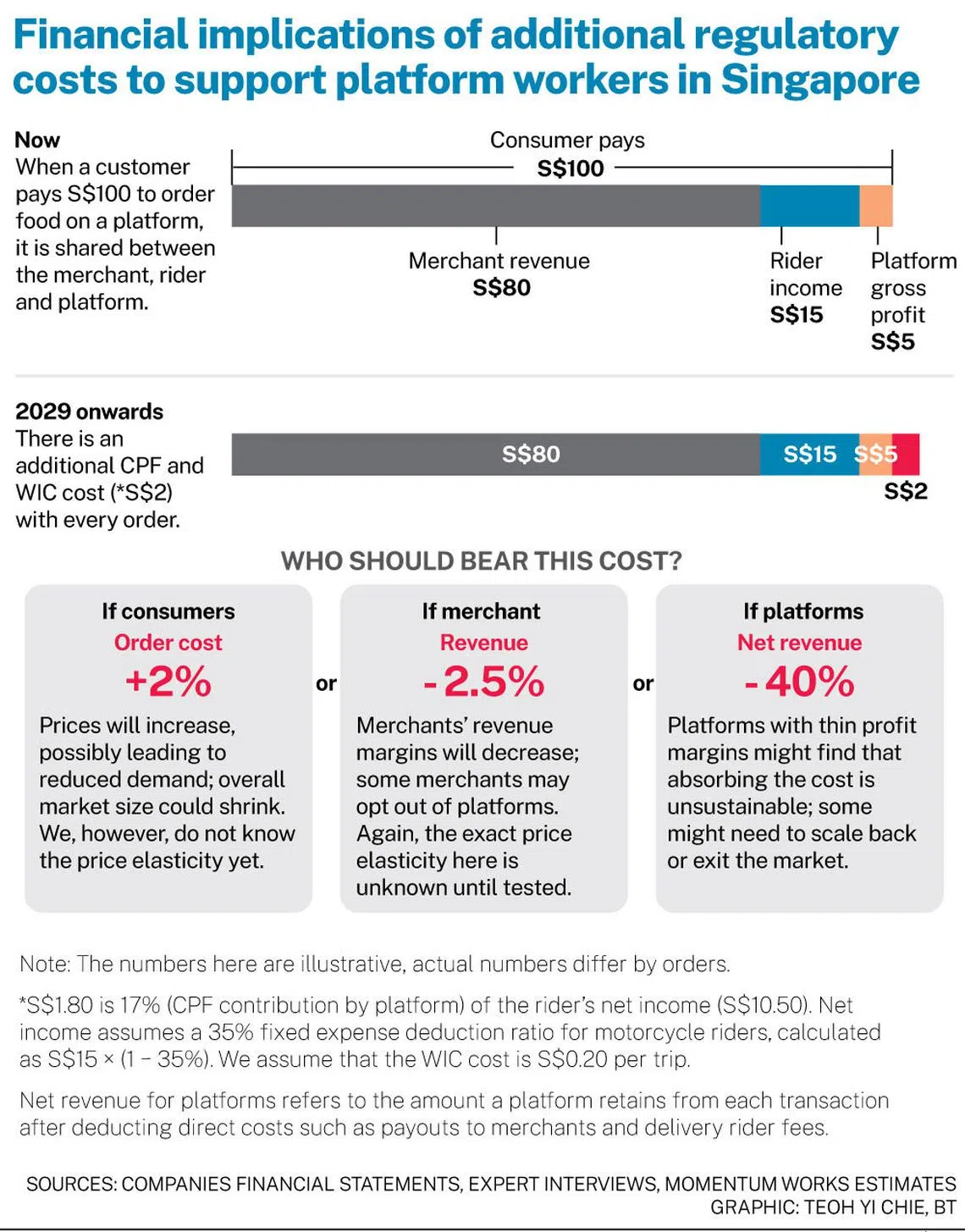

Prior to the CPF contributions, a S$100 order would see riders get S$15 while platforms get S$5. After CPF contributions, a S$100 order would see an additional S$2 being carved out to pay for CPF contributions.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Momentum Works estimates that customers would pay 2 per cent more if the CPF costs are passed on to them. Merchants would see a 2.5 per cent drop in revenue if they have to pay for CPF costs. Platforms might see a 40 per cent decline in revenue if the CPF costs are absorbed by them.

The Platform Workers Bill was introduced in Parliament in August this year, with the protections for platform workers in Singapore expected to kick in from Jan 1, 2025.

This was after a set of recommendations by the Advisory Committee on Platform Workers was accepted. The committee spent the past year reviewing how Singapore should better protect this group of people. Platform workers have thus far been treated as self-employed persons.

The changes are set to affect more than 73,000 platform workers, comprising 30,600 private-hire car drivers, 16,700 delivery workers and 26,300 taxi drivers. However, the street-hail jobs of cabbies will be excluded from the measures.

Li Jianggan, founder and chief executive officer of Momentum Works, said in response to the findings: “We may see prices for platform services going up, which could dampen the demand for their services initially, but ultimately increased prices will better reflect the true cost of fair labour practices in the long term.”

He added: “With the substantial additional costs, platforms of all sizes will need to adjust their business models going forward.”

*Amendment note: An earlier version of this story noted that the US$368 million figure is an annual cost increase. It is actually a cumulative figure from 2025 to 2029. We also clarify that the 12.1 per cent workers’ CPF contribution figure is an approximation of the age group split across platform workers by the Momentum Works report.