MUMBAI: A relatively weak rupee, in the short term, benefits India’s trade balance, a report published by RBI said. However, in the long run, a stronger rupee is more beneficial to trade balance. Trade balance is the difference between exports and imports of goods and services.

The report, published in RBI’s Nov bulletin, carries data on the real effective exchange rate (REER), which points to an overvaluation of the rupee in relative terms in Nov as other currencies depreciated at a higher rate against the dollar. REER is an index that measures the country’s currency against a basket of other currencies.

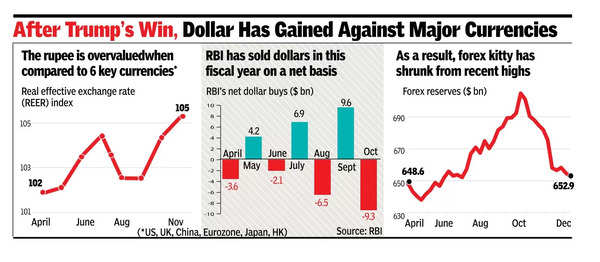

According to data published by RBI, the 40-country trade-weighted REER index rose from 90.9 to 91.8 in one month while the six-currency basket rose from 104.4 to 105.3. The six countries in the smaller basket are the US, China, Eurozone, Hong Kong, the UK and Japan.

Following Donald Trump’s win in the US presidential election in early Nov, the dollar has gained against all major currencies including the rupee. However, the depreciation of the rupee against the dollar has been less than that of other currencies resulting in an appreciation of the REER.

The researchers note that rising productivity in the tradable goods sector in India has played a role in the continued appreciation of the REER. The report suggests that policymakers need to be mindful of the asymmetric and time-varying impact of REER changes on the trade balance.

The REER is also important from a financial stability perspective. In the past, IMF had noted the importance of monitoring REER fluctuations as part of broader financial stability assessments as historical data shows that significant deviations in the index can precede financial crisis.