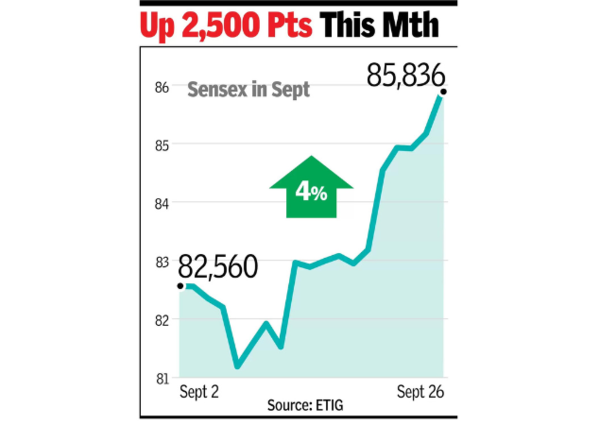

MUMBAI: The sensex rose 666 points to 85,836 on Thursday, while Nifty advanced 212 points to close at a record high of 26,216. The sixth consecutive session of gains was driven by a rally in auto and metal stocks. While automakers surged on hopes that state govts would offer tax cuts and incentives for hybrid vehicles, metal stocks benefited from higher global prices.

The sensex hit an intraday peak of 85,930, and Nifty touched a high of 26,251 during the day’s session. Of the 30 sensex stocks, 28 ended the day in green, with Maruti, Tata Motors, Bajaj Finserv, Mahindra & Mahindra, and Tata Steel being the top gainers. L&T and NTPC were the two stocks that declined.

“The market is experiencing strong liquidity flows. Foreign institutional investors have become buyers in Sept with net purchases of Rs 24,000 crore. Mutual funds and local investors are also buying, and there are no major sellers,” said Nilesh Shah, MD at Kotak Mutual Fund. Despite the strong inflows, the rupee weakened slightly to 83.64 against the dollar, down from 83.59, due to increased demand for the dollar from importers.

Sector-wise, the auto index surged 2.2%, metal stocks gained 2.1%, and others like commodities (1.3%), FMCG (0.8%), and consumer discretionary (0.8%) also contributed to the rally. However, industrials, telecommunications, and utilities lagged.

According to Shah, liquidity alone cannot sustain a rally that was seen in past bull runs in 1998, 2000 and 2008. “What we are now witnessing is a Triveni Sangam of liquidity, sentiment, and fundamentals. From FY10-20, corporate profits grew at a CAGR of under 3% and between FY20-24, profits have grown nearly four times to Rs 15 lakh crore. When there is a fourfold growth in profits, markets will go up. There is also a sentiment that India’s time has come.”