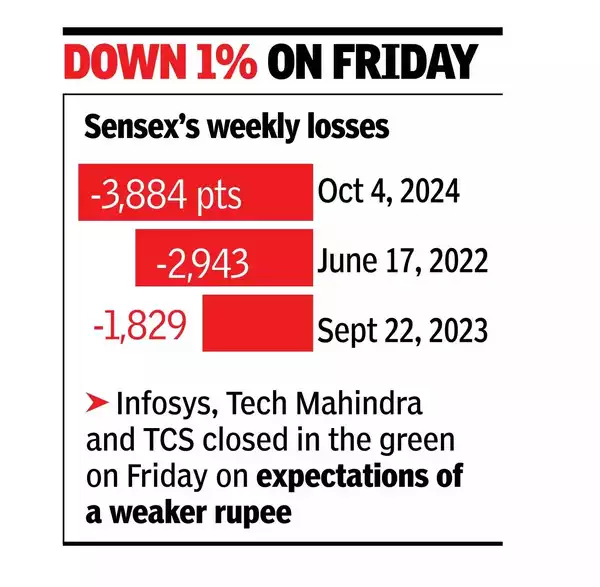

MUMBAI: The sensex recorded its worst week since June 2022, dropping 3,884 points or 4.5%, as concerns over the escalating conflict in West Asia and selling by foreign investors dragged the index down. In Friday’s session, the sensex fell 809 points or 1% to 81,688 while Nifty closed 0.9% lower at 25,015.

Over the week, BSE-listed firms’ market capitalisation fell by Rs 16.3 lakh crore.Nifty, in line with the sensex, fell 4.5% – 1,164 points lower – as geopolitical tensions raised fears of potential disruptions to crude oil supplies from West Asia, pushing prices higher. Brent crude futures were up 66 cents, or 0.85%, at $78.3 a barrel.

Brokers attributed the market decline to aggressive foreign selling too, with outflows from Indian markets reaching a record high as investors redirected their focus to China following recent stimulus measures. Foreign institutional investors offloaded equities worth Rs 15,243 crore on Thursday alone when the market fell by over 2%. In the last three sessions, FIIs sold shares worth Rs 30,614 crore while investing in China, which saw inflows of over $13 billion in the week.

While the sensex was down nearly 1,000 points at 81,532 in intraday trades on Friday, Nifty fell to a low marginally below the 25,000 level. Brokers said that Nifty’s breach of the 25,000 resistance level indicated weak sentiment. “Negative bias continued for the fifth-straight session amid rising fears of a surge in crude oil prices due to the ongoing West Asia war. If oil prices continue to spike, higher inflation could further delay the prospects of a rate cut by RBI,” Prashanth Tapse of Mehta Equities, said.

Only the metals sector, led by JSW Steel, recorded gains, while other major sectoral indices – like realty, auto, and energy – were hard hit and logged weekly losses.