REAL incomes in Singapore made a rebound in 2024 as inflation eased, recovering from the previous year’s decline, the Ministry of Manpower’s (MOM) annual Labour Force in Singapore Advance Release report showed on Thursday (Nov 28).

For full-time workers, the nominal median gross monthly income including Central Provident Fund (CPF) contributions rose to S$5,500 this year, up 5.8 per cent from 2023.

After adjusting for inflation, real income growth was 3.4 per cent, according to preliminary estimates, recovering from a decline of 2.2 per cent in 2023.

At the 20th percentile, nominal median gross monthly income including CPF rose 7.1 per cent to S$3,026. For these lower-income workers, income grew 4.6 per cent in real terms, a turnaround from the 3 per cent decrease in 2023.

Manpower Minister Tan See Leng said he is confident that low-wage workers can continue to expect income increases in the coming years as wage requirements negotiated by tripartite partners under the Progressive Wage Model are gradually rolled out.

The faster income growth at the 20th percentile, compared with the median, “is a good thing because it means that income inequality is actually narrowing”, Ang Boon Heng, director of manpower research and statistics at MOM, said at a separate media briefing.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

The ministry did not provide a comparison between income growth for lower-income workers and high-income earners, such as those at the 90th percentile.

Asked about the employment outlook in the coming year, Dr Tan alluded to further geopolitical uncertainty, noting that US president-elect Donald Trump has announced plans to impose tariffs on America’s closest trading partners.

Still, Singapore remains “cautiously optimistic” about growth, he said. The official economic growth forecast range for 2025 is 1 to 3 per cent.

“It’s better to be optimistic but also be pragmatic and realistic, to have a certain sense of healthy embracing of making sure that you prepare yourself for the worst, should it happen,” he said.

“Of course, if it doesn’t happen, we are really in a very good state.”

Slower five years

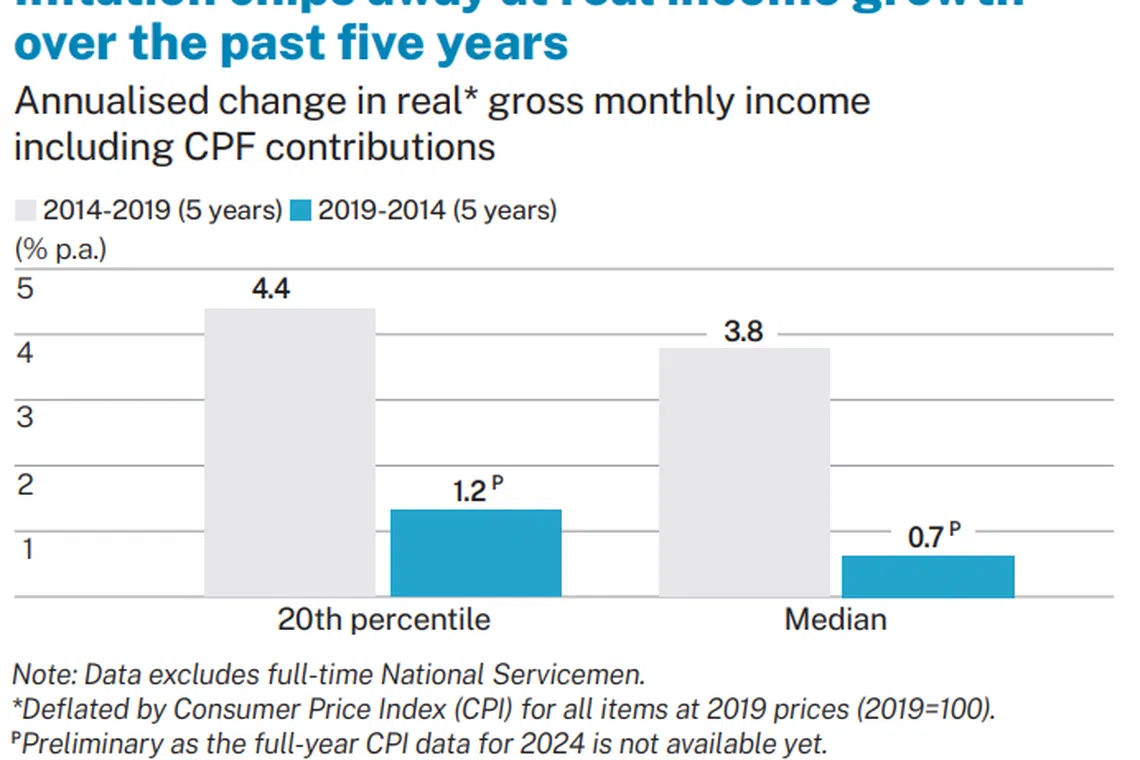

Despite the improvement in 2024, median real income growth for 2019 to 2024 was just 0.7 per cent per annum, compared with 3.8 per cent per annum in the five years prior.

This is because higher inflation in the last five years has “eroded sustained growth in nominal incomes”, said the report.

Still, MOM’s data showed that income growth was supported by productivity gains. The ministry’s index of productivity, measured by value added per worker, remained higher than that of mean income of employed residents – though this productivity-income gap narrowed in the first half of 2024.

Meanwhile, the majority of job switchers who changed industries in the last one year saw increases in income, with 59.3 per cent of them seeing real income grow at least 5 per cent.

“That’s an important thing because we need to focus on getting a lot more people to move to more productive sectors, to better industries, and not stay in the unproductive sectors,” Ang said.

Of all job switchers, about a fifth reported lower real income, while the remaining fifth received similar wages as before.

Unemployment up in outward-oriented industries

Unemployment rates remained “low and within historical range”, said MOM.

The unemployment rate for professionals, managers, executives and technicians (PMETs) rose to 2.7 per cent in 2024, from 2.4 per cent the year before.

For non-PMETs, the unemployment rate fell to 3.4 per cent, from 3.6 per cent before.

In most industries, the unemployment rate declined or remained similar. But it rose in the outward-oriented industries of information and communications – to 5 per cent, from 3.8 per cent before – as well as financial and insurance services, to 3.8 per cent from 3 per cent previously.

This was “partly due to the rise in retrenchments from business restructuring as global economic headwinds impacted firms in these sectors”, said MOM.

Unemployment rates also rose by at least half a percentage point in manufacturing and accommodation.

The number of discouraged workers – those who are not actively looking for a job as they believe this search would not yield results – declined further to 7,400, from 9,100 before. They were 0.3 per cent of the resident labour force, down from 0.4 per cent in 2023.

The report also covered statistics on labour force participation, employment rates by age and gender, and type of employment.

The share of self-employed residents, for instance, declined to 11.8 per cent, from 12.2 per cent in 2023.

“This shift reflects both increased job openings and a growing preference for the stability and benefits offered by employee roles,” said the report.

The fall in self-employment was driven mainly by a fall in own account workers, to 8.1 per cent from 8.7 per cent before. Among these, platform worker numbers fell to 67,600 or 2.7 per cent of all employed residents, from 70,500 and 2.9 per cent the year before.

This was mainly due to declines in taxi drivers and private-hire car drivers. MOM said that “increased salaried work opportunities could have prompted these platform workers to take up salaried jobs as their regular job”.